Trade, Industry, or Profession (TIP) Credit Union Charter Overview

Learn about the TIP Charter—a designation within the Single Occupational Common Bond—and the Field of Membership opportunities it offers your credit union.

Learn about the TIP Charter, a designation within the Single Occupational Common Bond, and the Field of Membership opportunities it could offer your credit union.

What Is a TIP Charter?

One option for defining a Single Occupational Common Bond field of membership is through the Trade, Industry, or Profession Charter, more commonly referred to as a TIP Charter.

As described in the National Credit Union Administration (NCUA)’s Chartering and Field of Membership (FOM) Manual: “A common bond based on employment in a trade, industry, or profession can include employment at any number of corporations or other legal entities that—while not under common ownership—have a common bond by virtue of producing similar products, providing similar services, or participating in the same type of business.”

Who Is Eligible for Membership Under a TIP Charter?

Most often, a TIP Charter will carry with it a required geographic limitation, defined in a credit union’s charter and corresponding to its current or planned service area. This requirement, however, is not applicable to a credit union either serving a nationwide field of membership or operating across multiple states.

Further regarding geography, it is possible for more than one credit union to serve a particular TIP, even if both credit unions share the same geographic location.

As to the employee groups themselves, a credit union must prove that they are in fact closely related and demonstrate what the NCUA terms a “narrow commonality of interests” within a specific trade, industry or profession.

Despite this, there is one potential exception highlighted in the NCUA Manual: If it can be established that two entities share a “strong dependency relationship” and work directly with other entities within the industry, a TIP may then include employees from third-party vendors or suppliers.

How Do You Prove a “Strong Dependency Relationship” Between Entities?

The NCUA offers guidelines as to how a strong dependency relationship between two companies is to be established:

–A ‘strong dependency relationship’ between a TIP entity and its supplier/vendor must be demonstrated by their reliance on each other as measured by the presence of indicators of a likelihood that the absence of one would cause the other to suffer a material decline in either revenue, functionality or productivity.”

–Other ‘strong relationship’ indicators NCUA would consider include the regularity or frequency of work that employees of the entity perform at facilities directly related to the industry, or the degree to which employees must adjust their work practices to adapt to the needs of the industry.

For a credit union looking to add groups to a TIP Charter in this manner, a brief narrative must be included in the application “identifying indicators that support the existence of a strong dependency relationship between the TIP entity and its individual supplier/vendors.”

Examples of TIP Charter Fields of Membership

The NCUA Manual considers some potential sample fields of membership and whether or not they would meet the “narrow commonality” requirement:

For example, the manufacturing industry, energy industry, communications industry, retail industry, or entertainment industry would not qualify as a TIP because each industry lacks the necessary commonality. However, textile workers, realtors, nurses, teachers, police officers, or U.S. military personnel are closely related and each would qualify as a TIP.

[…]

If a credit union wants to serve a physician TIP, it can serve all physicians, but that does not mean it can also serve all clerical staff in the physicians’ offices. However, if the TIP is based on the health care industry, then clerical staff would be able to be served by the credit union because they work in the same industry and have the same commonality of interests.

If a credit union wants to include the airline services industry, it can serve airline and airport personnel but not passengers. Clients or customers of the TIP are not eligible for credit union membership (e.g., patients in hospitals). Any company that is involved in more than one industry cannot be included in an industry TIP (e.g., a company that makes tobacco products, food products, and electronics). However, employees of these companies may be eligible for membership in a variety of trade/profession occupational common bond TIPs.

It does likewise regarding the “strong dependency” designation:

Under this definition, a firm whose employees are specially trained to protect nuclear facilities, and whose employees work primarily at such facilities, could be a part of a TIP based on the firm's participation in the nuclear energy industry.

[…]

[A]n FCU may serve employees of companies within the commercial airline industry that have a strong dependency relationship with airlines or airports, without the limitation that these employees work at an airport. However, these employees must work directly with the following: Air transportation of freight, air courier services; air passenger services; airport baggage handling; airport security; commercial airport janitorial services; maintenance, servicing, and repair services; and on board airline food services. The employees of those entities have a narrow commonality of interests, share the single occupational common bond, and can be included within the Air Transportation Industry field of membership.

The Application Process

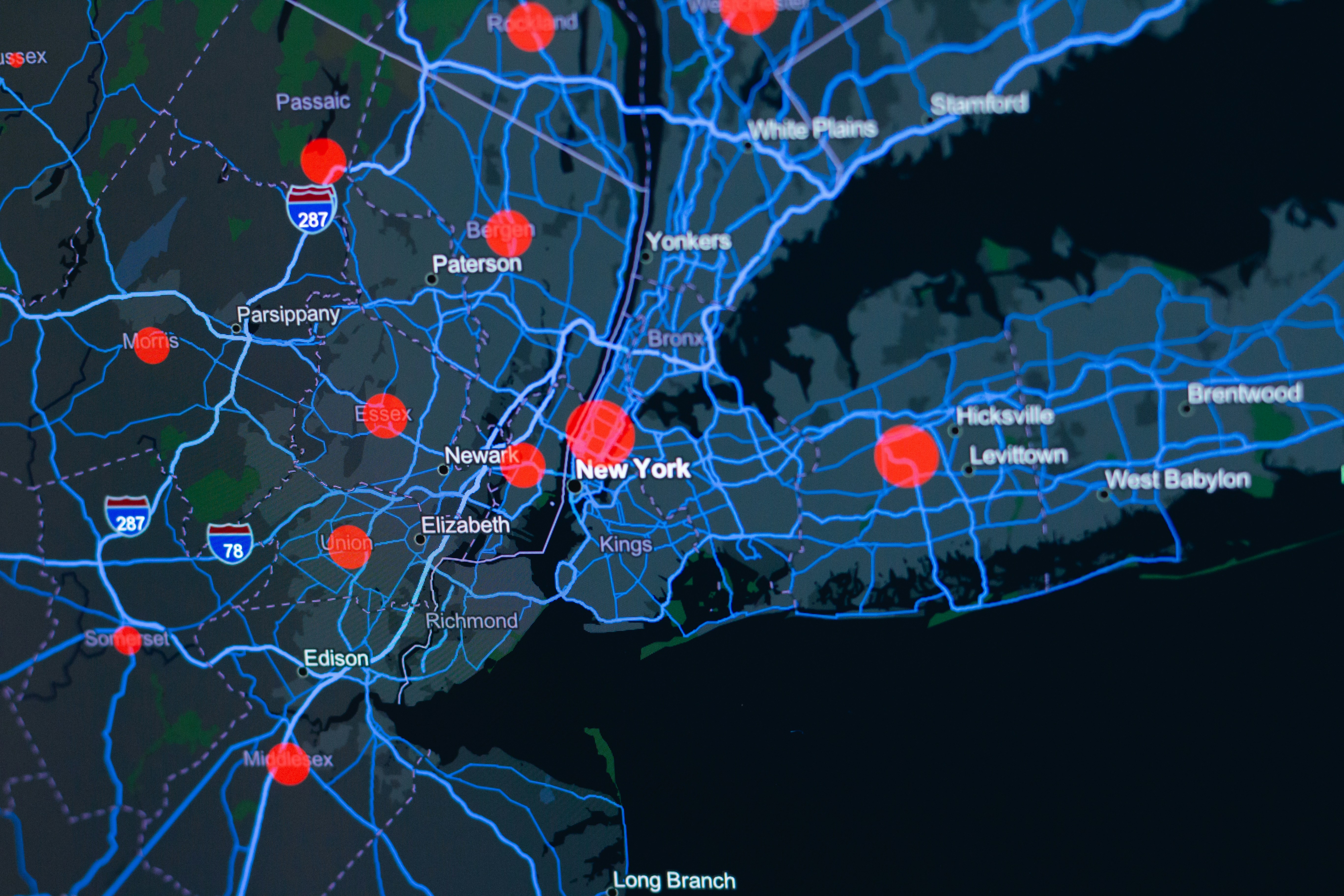

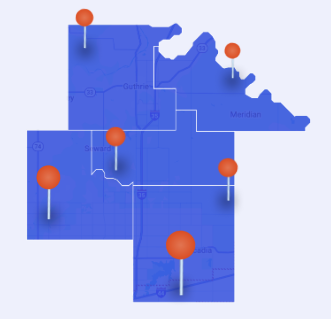

While a TIP Charter can be greatly beneficial to many credit unions looking to expand or covert an existing charter, it is by no means a one-size-fits-all process. Identifying the best strategy for your credit union can be both difficult and time-consuming. At CUCollaborate, we provide a tailored approach to growth based on data-driven insights and specialized software to help credit unions reach the largest target market possible.

Contact us today to learn about our Field of Membership Consulting Services.

Field of Membership Expansion

.jpg)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)