Mapping 2.0 is Here!

The transition to Mapping 2.0 marks a significant leap forward for credit unions.

We know better than anyone that credit unions are constantly seeking tools to stay ahead of the curve, understand their markets better, and identify growth opportunities. One such groundbreaking tool that has revolutionized market analysis and visualization for credit unions is our very own.

Introducing Mapping 2.0

The transition to Mapping 2.0 marks a significant leap forward for credit unions. Let's take a closer look at what this technology brings to the table.

1. Enhanced Data Visibility

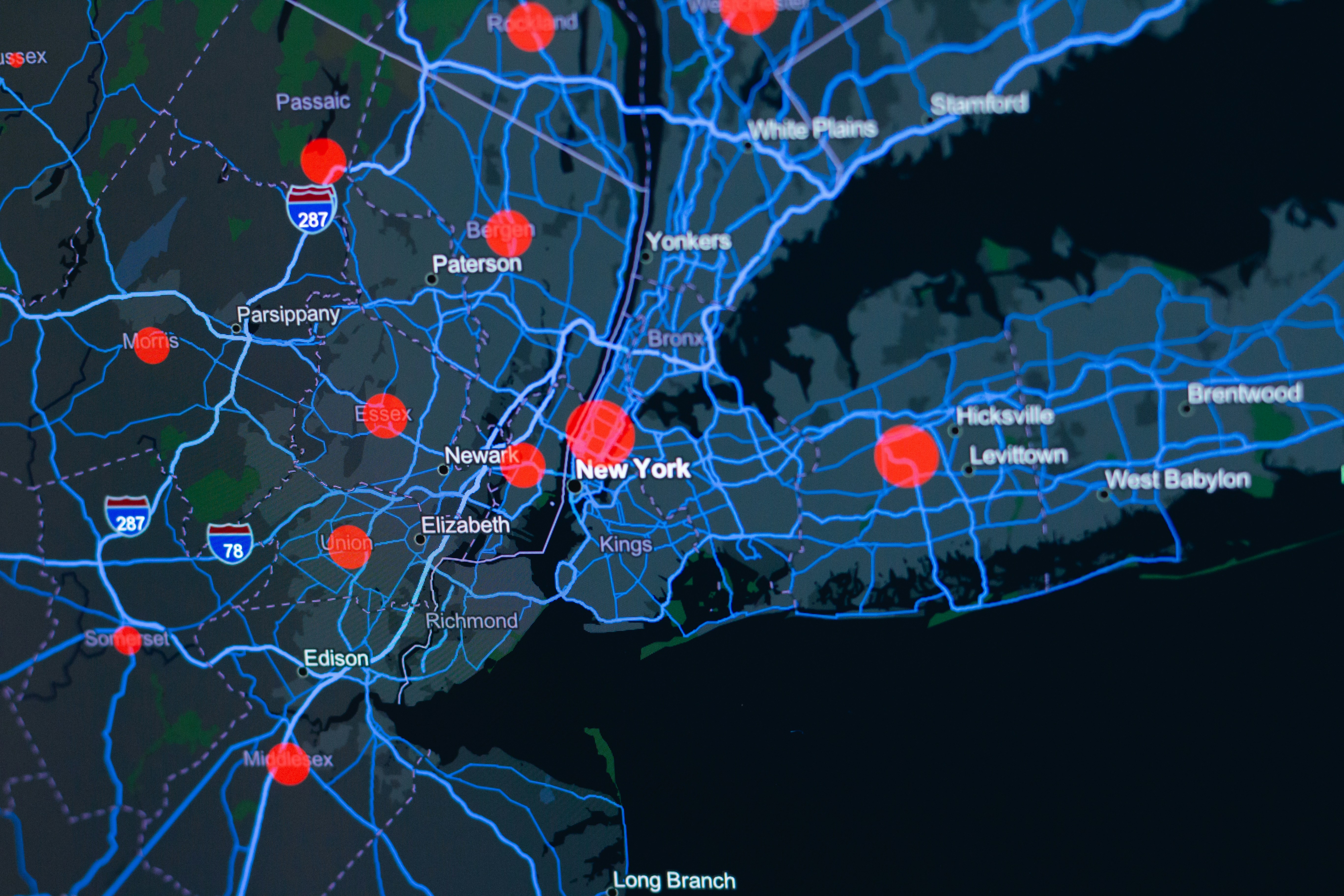

By leveraging Mapping 2.0, credit unions gain access to a wealth of data, empowering them to perform advanced market analysis with precision. This includes mapping internal data like member demographics, branch locations, and service areas, alongside public data and proprietary insights.

2. FOM Expansion Strategy

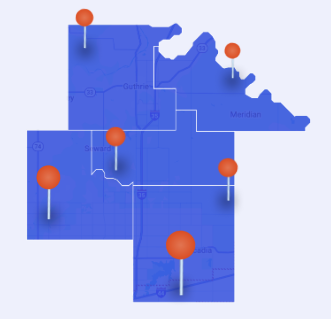

Crafting strategies for Field of Membership (FOM) expansion is now more efficient than ever. Credit unions can generate comprehensive FOM reports, facilitating informed decision-making when it comes to expanding membership and reaching new markets.

3. Easy Navigation

Navigating the credit union landscape and understanding the competitive environment is simplified through the modern mapping layer. Credit unions can effortlessly explore branch locations, CO-OP ATMs, and compare themselves with peers and industry competitors, gaining valuable insights into their positioning and opportunities for growth.

4. Demographic Insights

Understanding the demographics of specific regions is crucial for tailoring services and outreach efforts. With the modern mapping layer, credit unions can access demographic data at various levels, enabling them to target their initiatives effectively and serve their communities better.

5. Identification of Low-Income Designated Areas

Serving low-income communities is a cornerstone of the credit union philosophy. Mapping 2.0 facilitates the identification of Low-Income Designated areas, empowering credit unions to fulfill their mission of financial inclusion and social responsibility.

Embracing the Future of Growth Strategies

Incorporating the modern mapping layer into their operations positions credit unions at the forefront of innovation in the financial industry. By harnessing the power of data visualization and analysis, credit unions can:

- Optimize Expansion Strategies: Make informed decisions regarding FOM expansion, identifying underserved areas and growth potential with precision.

- Enhance Member Experience: Tailor services and outreach efforts based on detailed demographic insights, ensuring a personalized experience for members.

- Drive Community Impact: By identifying Low-Income Designated areas, credit unions can direct resources towards communities in need, fostering financial empowerment and inclusion.

Mapping 2.0 represents a paradigm shift in how credit unions approach market analysis and growth strategies. By leveraging this technology to its fullest potential, credit unions can discover new opportunities, better serve members, and make a positive impact in the communities they serve. As the financial landscape continues to evolve, embracing this software becomes not only a strategic advantage but a fundamental necessity for credit unions striving for sustained growth and relevance in the digital age.

Banking Technology & Innovation

.jpg)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)