How a Credit Union Can Qualify as a Minority Depository Institution

Learn about the process of qualifying to become a Minority Depository Institution and how your credit union can attain the designation and its benefits.

Table of contents

Qualifying as a Minority Depository Institution (MDI) can lead to several benefits for your credit union. Learn about the process and how your institution can attain the designation.

What is an MDI?

Credit Unions that self-certify to the NCUA as Minority Depository Institutions are federally insured credit unions in which a majority of their current members, board of directors, and the community they service, as designated in its charter, fall within any of the eligible minority groups as described in Section 308 of the Financial Institutions Reform, Recovery and Enforcement Act of 1989: any Black American, Asian American, Hispanic American, or Native American.

Important notes:

- Credit Unions self-designate as MDIs by answering the MDI questions posed to them on their CUOnline profile;

- The NCUA encourages Credit Unions to come to their own determination as to whether they qualify as an MDI;

- To qualify as an MDI, you must respond ‘yes’ to both minority depository institution questions in the profile;

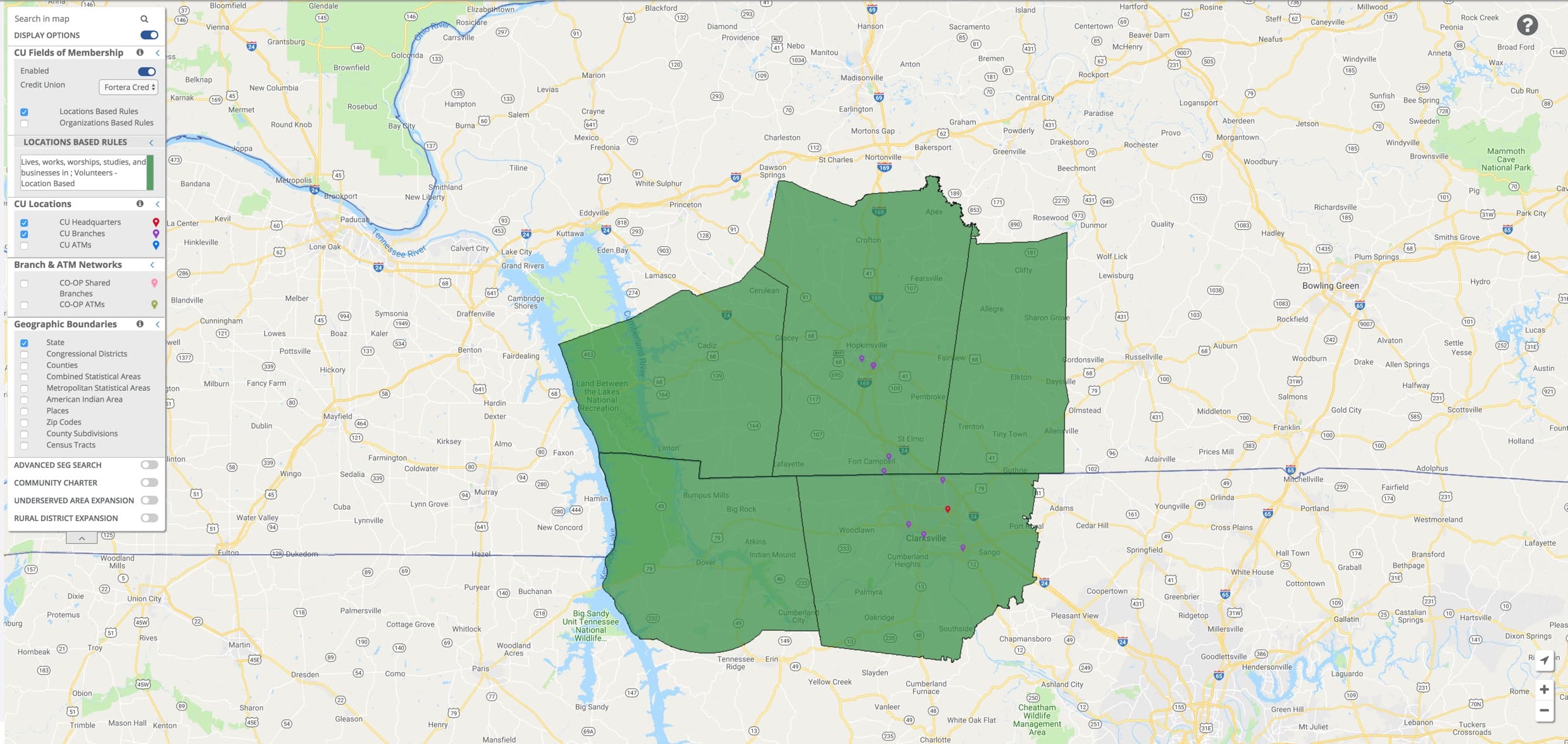

- All three conditions (current members, board of directors, and community served) must be met to be classified as a minority depository institution. The community served is defined as a credit union’s potential members according to the field of membership in its charter;

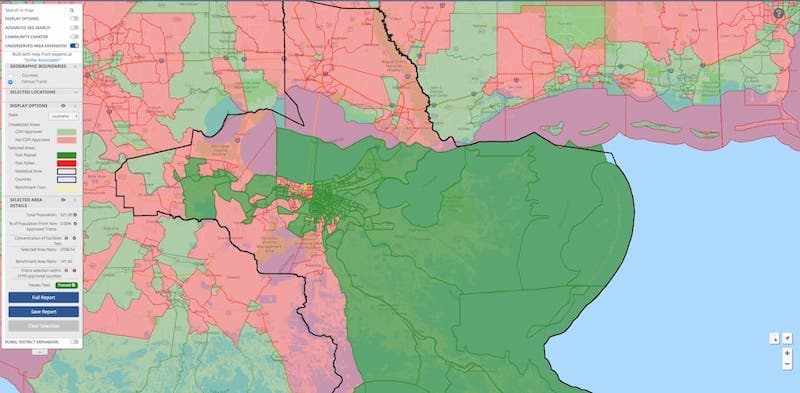

- The minority depository institution questions are based on a self-assessment, not a survey of the members. If you are unaware of the composition of your current membership and potential membership as defined in the field of membership of your charter, you may assess either one based on the U.S. Census data demographics of the area where most of your current and/or potential membership resides (township, borough, city, cities, county, counties, MSA, etc.). If the Census data show the area consists of more than 50 percent minority residents, you can assume your credit union’s field of membership resembles this composition;

- Participation in the MDI Program is voluntary. An MDI may discontinue its participation at any time by updating its status on NCUA's Credit Union Online system. In that event, the credit union would no longer be eligible to participate in any MDI Program initiatives (e.g., MDI merger/acquisition preference consideration or MDI partnerships).

The Benefits of MDI Certification:

- The NCUA’s Minority Depository Institution Preservation Program offers various forms of assistance to MDIs:

- Technical Assistance;

- Training;

- Chartering Assistance;

- If a Credit Union has a Low Income Designation:

- Grants;

- Loans;

- Access to the NCUAs MDI mentoring program.

Links for Further Reading:

- Minority Depository Institution Preservation | National Credit Union Administration (ncua.gov)

- Fact Sheet: Minority Depository Institutions (ncua.gov)

Appendix:

- MDI Question as it appears on your Credit Union Profile: https://www.ncua.gov/files/publications/regulations/credit-union-profile-form-4501A-june-2021.pdf

- From the instructions to the CU Profile https://www.ncua.gov/files/publications/regulations/credit-union-profile-form-instructions-4501A-june-2021.pdf (see pages 40–42 for information regarding MDIs).

- Minority Depository Institution Preservation Program Interpretive Ruling and Policy Statement 13-1 (https://www.federalregister.gov/documents/2015/06/24/2015-15515/minority-depository-institution-preservation-program).

- A credit union defined as a small entity under the Regulatory Flexibility Act (RFA) may self-certify >50% representation among its current members, and within the community it services (current and potential members combined), based solely on knowledge of those members. A credit union not defined as a small entity under the RFA may rely on one of the following methods, as applicable, to determine the minority composition of its current membership exclusively, and of the community it services, consisting of the combined current and potential membership:

(A) Ascertain the minority representation using demographic data from the U.S. Census Bureau (using the U.S. Census Bureau or FFIEC Web site) based on the area(s) where the combined current and potential membership resides, such as a township, borough, city, county, or Metropolitan Statistical Area (MSA). If the U.S. Census data (e.g., census tracts, zip codes, townships, boroughs, cities, counties, etc.) shows that the area's population is comprised mostly of eligible minorities, the credit union may assume that its current membership and the community it services both have the same minority composition as the U.S. Census data indicates.

(B) Use Home Mortgage Disclosure Act (HMDA) data to calculate the reported number of minority mortgage applicants divided by the total number of mortgage applicants within the credit union's membership. HMDA data can be obtained from the FFIEC Web site. If the share of minority representation among applicants is >50%, the minority membership and the predominantly community criteria may be met. If a credit union grants a majority of its mortgage loans to minorities, it is most likely the majority of the community the credit union services (its current and potential members) will consist of minorities.

(C) Elect to collect data from members who voluntarily choose to self-identify as an eligible minority and use the data to determine minority representation among the credit union's membership. The credit union may wish to consider using an unbiased third party to conduct such a collection process. For example, data can be collected through a survey of members assessing the services they desire, or by mailed electoral ballots for official positions. Once collected, it is essential to maintain the confidentiality of the data; it should not be retained in the members' file or with any personal identifiers (e.g., name, account or social security numbers, etc.) If a majority of its current members are minorities, it is most likely the majority of the community the credit union services (its current and potential members) will consist of minorities.

(D) Use any other reasonable form of data, such as membership address list analyses, or an employer's demographic analysis of employees.

- A credit union defined as a small entity under the RFA that self-identifies as an MDI should maintain some form of the documentation that it relied upon to determine that, as explained above, it meets the minimum minority representation among its membership. This documentation may consist of demographic data obtained from the U.S. Census Bureau, from a credit union's HMDA report, or from any other reasonable source and form of data (e.g., member survey, sponsor's employee demographic or members' zip code analysis).

- Regardless of asset size and the method a credit union uses to self-certify as an MDI, the validity of the self-certification (and the supporting data) is subject to verification by NCUA based on minority representation where the credit union's members reside.

- If NCUA questions a credit union's certification or the data supporting it (g., members' addresses) is found to be at odds with a credit union's self-certification of >50% minority representation among either its current membership, the community it services (consisting of current and potential members) or its board of directors, NCUA's OWMI will:

(1) Notify the credit union in writing about its reasons for invalidating the certification.

(2) Provide the credit union an opportunity to submit documentation and/or a rationale to support its MDI self-identification within 60 days of receiving OMWI's notification.

(3) Review the documentation and/or rationale the credit union submits and inform the credit union whether, as a result, it meets the >50% minority criterion.

(4) Deny the MDI designation if the credit union either provides no documentation and/or rationale, or provides documentation and/or rationale that, in NCUA's discretion, is insufficient to support a certification based upon >50% minority representation under all criteria.

- NCUA will periodically review and determine whether an MDI continues to meet the MDI definition. A credit union may no longer meet the MDI definition as a result of FOM expansions (e.g., mergers, purchase and assumptions, new groups added to the FOM, or charter conversions) and changes resulting from board of directors elections. NCUA, at its discretion, may continue to treat a credit union as an MDI under this final IRPS in the event its board of directors no longer meets the minority criteria, provided there is >50% minority representation among both the credit union's current members and the community it serves.

- Once it qualifies as an MDI, a credit union should annually assess whether it continues to meet the MDI definition (e.g., December 31st Call Report cycle), and update its status on NCUA's Credit Union Online Profile system as necessary.

Branch Strategy & Analysis

.png)

.png)